Trend Momentum Strategy Indicator

“Trend Momentum Strategy” is a momentum indicator that considers trades in price ranging above the SMA50 (editable) and RSI SMA 60 (not editable) in conjunction with prices below the upper band of the Bollinger Bands to find trades.

This indicator plots trades on your chart to follow

Adjustable stop loss and take profit targets

Runs in REAL TIME on any time frame

Multiple customizable options for strategy configuration

Works on all cryptocurrency, stock, and forex pairs

R2,900

Introduction Video

Know The Creator

Edward Gonzales

Is a technical analyst, professional day trader and content creator that has been involved in cryptocurrency since April 2017.

Through his passion for cryptocurrency education, he was able to connect with Crypto University and join the team in January 2021. He works closely with the students in our private group to assist in learning and strategy development.

Edward also writes blogs for the university website. Specializing in passive income methods, Edward aims to bring a deeper understanding of algorithmic trading to Crypto University and our students. He’s also the creator of Crypto Automated Trading Course.

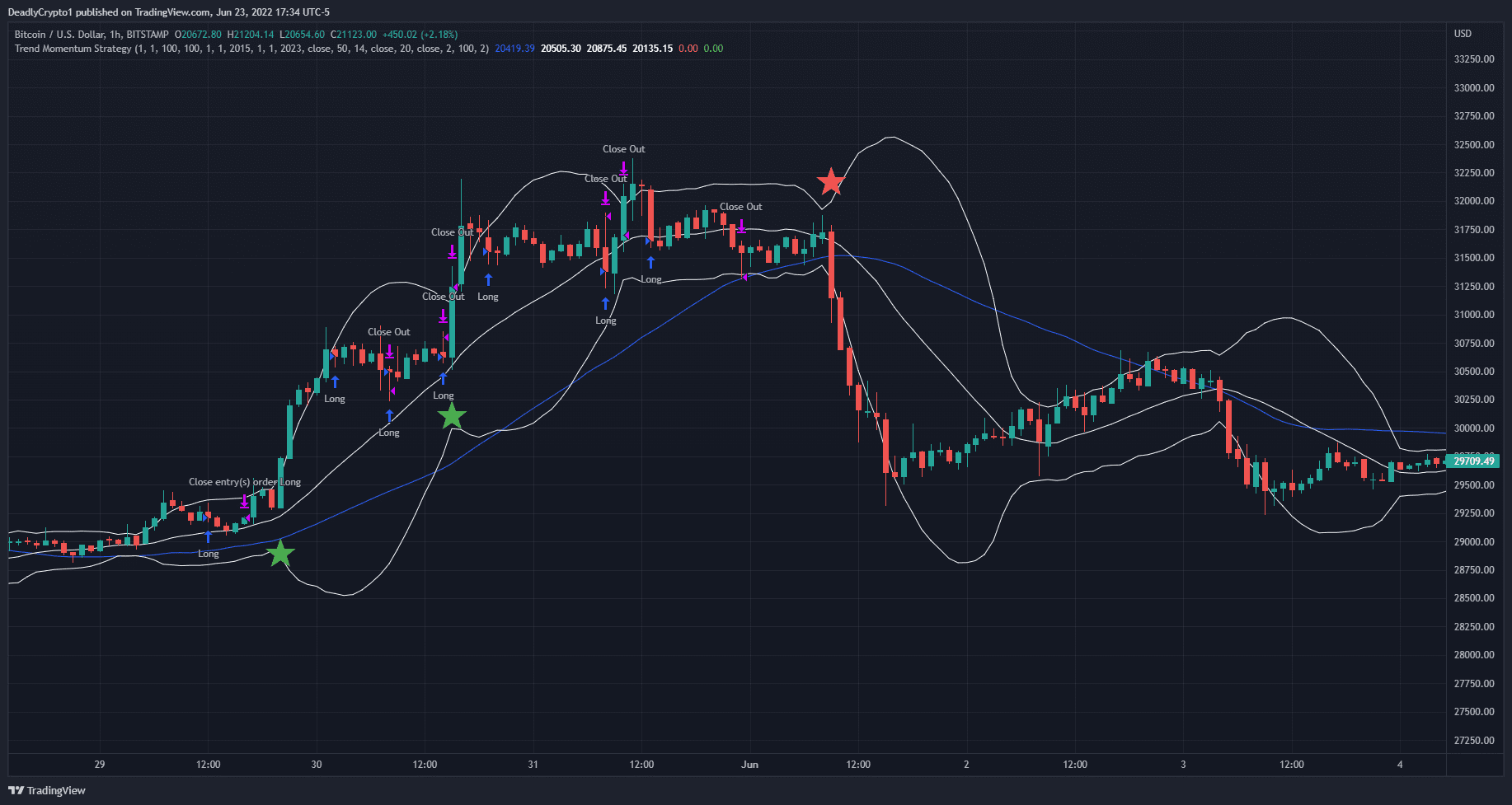

Work in Action

TradingView screenshots which shows how the indicator works

About the Indicator

“Trend Momentum Strategy” is a momentum indicator that considers trades in price ranging above the SMA50 (editable) and RSI SMA 60 (not editable) in conjunction with prices below the upper band of the Bollinger Bands to find trades.

There is an option to add/remove stochastic measurements to the strategy which can improve its performance in some assets/time frames. The user can input desired take profits and stop loss goals or trailing take profit and trailing stop loss goals. The range to be back tested can be specified by the user. The overlays are titled, optional, and can be turned on/off.

This strategy primarily looks for long positions in an area of upwards momentum, however there is an option to include bearish engulfing shorts entries. This bearish engulfing short entry mechanism was added to potentially short the ends of the upwards momentum moves without being involved in a downtrend for too long. Although the strategy was not designed for shorts alone, the user can remove all long entries and only see short bearish engulfing patterns.

How it Functions

VISUALS

- The blue upwards pointing arrows indicate long entries. The pink downward pointing arrows indicate close signals from the previous long entry signal.

- The red downward pointing arrows indicate short entries. The pink upwards pointing arrows indicate close signals from the previous short entry signal.

- The numbers under the arrows indicate how much of the asset was purchased By default this value is 1,000 USD equivalent but can be changed by the user in the “Properties” tab.

- The green stars under the candlestick represent bullish engulfing candlesticks . The visibility, color, and image can be edited in the “Style” tab.

- The red stars on top of the candlesticks indicate bearish engulfing candlesticks . The visibility, color, and image can be edited in the “Style” tab.

- The blue line is the SMA ( Simple Moving Average ). The value can be adjusted in the “Inputs” tab. The visibility and color can be edited in the “Style” tab.

- The white lines indicate the upper, middle, and lower ranges of the Bollinger Bands . The “Middle Band Length”, “BB Source”, and “Standard Deviation” values can be adjusted in the “Inputs” tab. The visibility and color can be edited in the “Style” tab.

INPUTS

- Apply Stoch – By checking this box you apply a stochastic filter to the conditions for long entries.

- Short Engulfing – By checking this box you enable short trade entry conditions for short engulfing patterns that occur after an uptrend swing has ended.

- RSI Long – By checking this box you apply an RSI SMA filter to the conditions for long entries.

- Trailing Stop Loss – By checking this box you apply a trailing stop loss to the strategy back tester. If this is not enabled, then the back tester will use the values of “Stop Loss %” and “Profit Take %”.

- Stop Loss % – The strategy will close a trade for a loss at this value which can be edited by the user.

- Profit Take % – The strategy will close a trade for a profit at this value which can be edited by the user.

- Trailing Stop Long % – The strategy will implement a trailing stop for long positions at this value if the “Trailing Stop Loss” box is checked. If the value is 100, the trailing stop loss is disabled and only the strategy close condition will be used.

- Trailing Stop Short % – The strategy will implement a trailing stop for Short positions at this value if the “Trailing Stop Loss” box is checked. If the value is 100, the trailing stop loss is disabled and only the strategy close condition will be used.

- Start Month – Input the month number for the back test beginning here.

- Start Day – Input the day number for the back test beginning here.

- Start Year – Input the year number for the back test beginning here.

- End Month – Input the month number for the back test ending here.

- End Day – Input the day number for the back test ending here.

- End Year – Input the year number for the back test ending here.

- SMA Source – Input the number to use as the simple moving average source value.

- SMA Length – Input the number to use as the simple moving average source length.

- RSI Source – Input the number to use as relative strength index source value.

- BB Middle Band Length – Input the number to take the middle band of the bollinger bands value from.

- BB Source – Input the number to take the bollinger bands source value from.

- Standard Deviation – Input the number to take the standard deviation of the bollinger bands from.

- Close After Sessions LONG – This value will force close a long position after the number of candlesticks specified regardless of profits or loss.

- Close After Sessions SHORT – This value will force close a short position after the number of candlesticks specified regardless of profits or loss.

PROPERTIES

- Initial Capital – The amount of capital in the total portfolio. 1,000 by default. Can be changed by the user.

- Base Currency – The currency to be used as base. USD by default. Can be changed by the user.

- Order Size – Field 1) The amount of funds to be used per trade. Field 2) Can be changed to the base currency, percent equity, or contracts purchased/sold.

- Pyramiding – How many orders can be placed for a single trade. 1 by default. Can be changed by the user.

- Commission – Exchange/broker commission rates (maker/taker fee). 0 by default. Can be changed by the user.

- Verify Price For Limit Orders – Number of ticks past limit price that must be reached for a limit order to be filled. 0 by default. Can be changed by the user.

- Slippage – The amount of ticks to be added to the fill price of market stop orders. 0 by default. Can be changed by the user.

- Margin For Long Positions – Percent of equity required to fund long positions. 0 by default. Can be changed by the user.

- Margin For Short Positions – Percent of equity required to fund Short positions. 0 by default. Can be changed by the user.

- Recalculate – After Order Is Filled) Enables an additional intrabar calculation after an order is filled. On Every Tick) Recalculates the strategy on each update of real time bars.

STYLE

- SMA – This depicts the simple moving average as a line. The visibility and color can be changed. Check this box to enable or disable.

- Middle Band – This depicts the middle band of the bollinger bands as a line. The visibility and color can be changed. Check this box to enable or disable.

- Upper Band – This depicts the upper band of the bollinger bands as a line. The visibility and color can be changed. Check this box to enable or disable.

- Lower Band – This depicts the upper band of the bollinger bands as a line. The visibility and color can be changed. Check this box to enable or disable.

- Bearish Engulfing – This plots bearish engulfing candlesticks on the chart. The visibility, color, and image can be changed. Check this box to enable or disable.

- Bullish Engulfing – This plots bullish engulfing candlesticks on the chart. The visibility, color, and image can be changed. Check this box to enable or disable.

- Trades On Chart – By checking this box you can add or remove the trade arrows, signal labels, and entry quantities from the chart.

- Signal Labels – By checking this box you can add or remove the strategy direction text from the trades on the chart.

- Quantity – By checking this box you can add or remove the quantity of asset purchased from the trades on the chart.

- Precision – N/A Value.

- Labels On Price Scale – By checking this box you can add or remove the labels from the price scale.

- Values In The Status Line – By checking this box you can remove the values from the status line of the indicator.

VISIBILITY

-

Set the time frames you would like the strategy back tester to be visible on.

Our philosophy here at Crypto University 🏆

Beginner Friendly

I have learned so much and refined so much of my knowledge about Bitcoin and Altcoins…and just being a more intentional investor than others

Learn at your pace

We have endless amount of content. You pick and choose which area to start with based on your goals or prior experience. You can also refer back to our lessons whenever faced with a challenge.

Community Support

You’ll be part of our Discord server where you can ask questions to experts and other learners.

FAQs

How does the Trend Momentum Strategy work?

The strategy allows the user to take positions based on the presence and strength of an uptrend.

How do I set up the Trend Momentum Strategy in TradingView?

It comes with default values but is fully customizable. Please watch this video to understand your new indicator fully. Tutorial video

Do I have to pay for TradingView to use the Trend Momentum Strategy?

With a free TradingView account you can use up to three indicators simultaneously at no cost.

I bought the Trend Momentum Strategy but I don’t have access to it. What now?

Access is typically granted within 1-24 hours after purchase. If it has been longer than 24 hours since your purchase, Please join our discord server here and visit our #get-support channel to get a ticket, or send an email to [email protected]

I provided the wrong TradingView username at checkout. How can I change this?

Please join our discord server here and visit our #get-support channel to get a ticket, or send an email to [email protected]

How do I open the Trend Momentum Strategy in TradingView?

Once logged into your TradingView account, select “charts” > “indicators” > “invite only scripts” > add your new indicator to your chart. (Press the star icon to favorite the indicator and make it appear in your favorites section.)

What if I change my TradingView username or lose. access to my TradingView account that has the indicator?

Please join our discord server here and visit our #get-support channel to get a ticket, or send an email to [email protected]