No Adverts are available No Adverts are available

No Adverts are available

Why Your Crypto Exchange Might Not Be Available Tomorrow

Grey Jabesi • 14 January 2026

No Adverts are available

No Adverts are availableThe promise of cryptocurrency is a global, borderless financial system. Yet, the reality for most traders is a fractured landscape of regulatory hurdles, regional restrictions, and sudden service withdrawals. You might wake up one morning to an email informing you that your exchange is ceasing operations in your country, leaving you with a tight deadline to liquidate your assets and find a new platform. This isn’t a hypothetical scenario; it’s a recurring event in the crypto industry, affecting traders from the UK to Canada and beyond.

The core of the problem is the tension between the decentralized nature of crypto and the centralized authority of national regulators. Exchanges, as centralized entities, must navigate a complex and ever-changing web of rules. A platform that is fully compliant today might find itself on the wrong side of a new policy tomorrow. For traders, this creates a persistent, low-level uncertainty. The platform you’ve grown to trust, the one that holds your assets and trading history, could become inaccessible with little warning, forcing you to start over.

This is where an exchange’s regulatory strategy and operational history become critical factors. While some platforms expand aggressively and deal with regulatory issues as they arise, others take a more deliberate, compliance-focused approach. BTCC, for example, has made a point of securing regulatory licenses in multiple jurisdictions, including a Money Services Business (MSB) registration with FinCEN in the US, a FINTRAC license in Canada, and approvals in Europe [1]. This multi-jurisdictional approach provides a degree of stability, suggesting a long-term commitment to the markets it serves.

A Fact-Based Look at Global Access

The challenge of global access is not uniform across all platforms. An exchange’s country of origin, corporate structure, and attitude toward regulation all play a significant role in its availability.

| Exchange | US Availability | UK Availability | Canada Availability | Key Regulatory Status |

| BTCC | Yes (MSB License) | Yes | Yes (FINTRAC License) | Multi-jurisdictional licenses |

| Bybit | No | Yes (via partnership) | No (withdrew 2023) | MiCA alignment (EEA), SCA license (UAE) |

| Coinbase | Yes | Yes | Yes | US-regulated, publicly traded |

Sources: Official exchange statements and regulatory disclosures [1] [2] [3]

Bybit’s journey is a case in point. In 2023, it withdrew its services from Canada and the UK, citing regulatory headwinds [2]. While it has since re-entered the UK market through a partnership with an FCA-regulated firm, the initial withdrawal highlights the volatility of platform access. Coinbase, as a US-based and publicly traded company, offers robust access in its home market but navigates international markets with the same caution as any other major financial institution.

BTCC’s strategy appears to be one of proactive compliance. By obtaining licenses in key markets like the US and Canada, it has established a legal framework to operate where many of its competitors cannot. This doesn’t make it immune to future regulatory shifts, but it does indicate a strategy of working within the existing system rather than around it.

Industry Comparison: The Price of Stability

Choosing an exchange often involves a trade-off between features and stability. Platforms that push the boundaries with high leverage and novel products may also be the first to attract regulatory scrutiny. Those that prioritize compliance may move more slowly but offer a more predictable and stable trading environment.

As a review on HackerNoon notes, BTCC’s long history is a testament to its adaptive strategy: "Operating for over a decade requires a deep understanding of the regulatory environment. BTCC’s survival is not an accident; it’s the result of a deliberate approach to risk and compliance." [4]

The experience of Bybit users in Canada serves as a stark reminder of the importance of this stability. The platform’s withdrawal forced traders to migrate their assets, often at inconvenient times, and sever their connection with a platform they had integrated into their trading workflow. While Bybit’s features are compelling, their availability proved to be conditional.

For traders outside of the major markets, the question of an exchange’s commitment to their region is paramount. A platform’s investment in local licenses and compliance is a strong signal of its long-term intentions. While the allure of a feature-rich but unregulated exchange is strong, the hidden risk of a sudden service termination is a price many traders are unwilling to pay. The most valuable feature an exchange can offer is the assurance that it will still be there for you tomorrow.

This article was written by a senior analyst at Crypto University. The information contained herein is for educational purposes only. Always verify an exchange’s availability and regulatory status in your specific jurisdiction before trading.

References

[1] BTCC Official Website & Academy Documentation. (btcc.com)

[2] CoinBureau. (2026). Bybit Review 2026: Features, Safety, Fees, Pros & Cons.

[3] NerdWallet. (2025). Coinbase Review 2026: Pros, Cons and How It Compares.

[4] HackerNoon. (2025). BTCC.Com Exchange Review: We traded $100,000 On 14 Year Old Veteran Crypto Exchange.

Share Posts

Copy Link

cryptouniversity.networkblog/why-yo...

Grey Jabesi • 1 January 1970

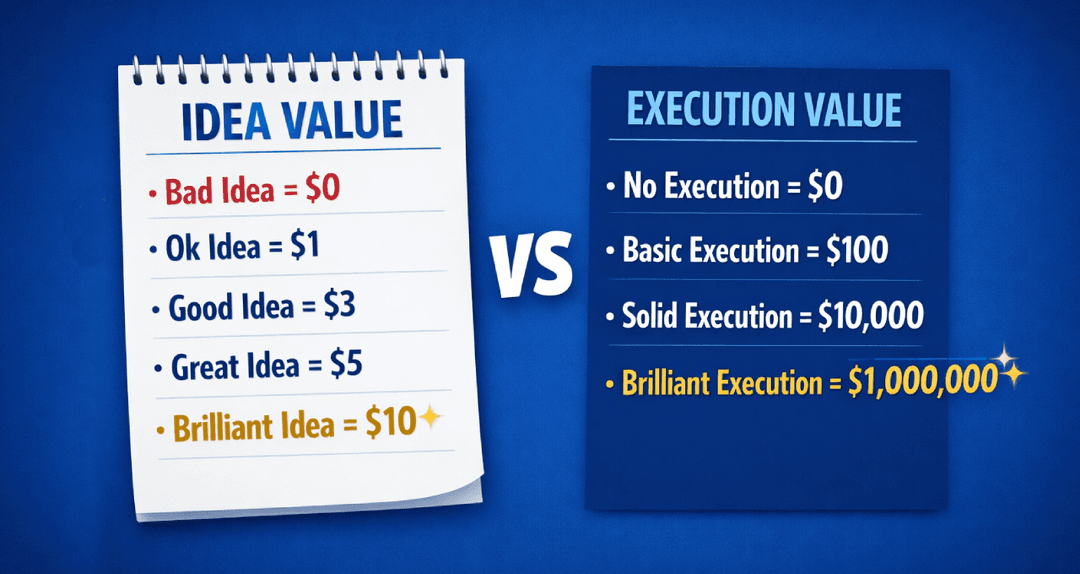

Your Brilliant Crypto Idea is Worthless

Discover why most crypto ideas fail and how superior execution — powered by top platforms like BTCC and Manus AI — separates winners from dreamers in the competitive crypto market.

Grey Jabesi • 1 January 1970

The Most Expensive Way to Learn Crypto Trading is With Real Money

Discover why learning crypto trading with real money is the most expensive mistake. Explore demo accounts on BTCC, Bybit & Coinbase to practice risk-free and protect your capital.

Grey Jabesi • 1 January 1970

The Beginner's Dilemma: Choosing Your First Crypto Exchange

New to crypto? Compare beginner-friendly Coinbase vs powerful BTCC with demo account. Choose the perfect first exchange based on your goals: simple buying or serious trading.