No Adverts are available No Adverts are available

No Adverts are available

HOW CARDANO STAKING WORKS

Ayomide Abimbola • 24 October 2021

No Adverts are available

No Adverts are availableStaking is a method of locking up coins to gain rewards in a particular network. Staking is available to networks that use the proof of stake model to process transactions. It is a new way to generate passive income by using your ADA to earn at a high-interest rate. Some common keywords in Cardano staking are:

Stake pool - There are two types

- Public Staking pool - This is a trusted and reliable server node to which many users can delegate their crypto and expect to receive rewards later. It focuses on the maintenance and holds the combined stake of various users in a single entity.

- Private Staking pool - In this case, the stake pool only delivers rewards to its owner.

These are the two ways in which an ADA holder can earn rewards. Firstly, they can delegate to a stake pool run by someone else, a Public Staking pool. Or secondly, they can run their own Private staking pool.

The amount of stake delegated to a given stake pool is the primary way the Ouroboros mechanism decides who adds the next block to the blockchain and receives a reward for doing so.

Also, the more stake is delegated to a stake pool, the more chance it has to produce the next block, and the reward is shared amongst all the stakeholders in that pool.

The Ouroboros mechanism is a system that allows a slot leader to produce a new block based on the amount of staking delegated to it or the number of tokens it owns.

To optimize the highest level of performance that is available, a Cardano pool operator has to consider the three levers:

- Pool pledge

- Pool margin

- Pool fixed cost

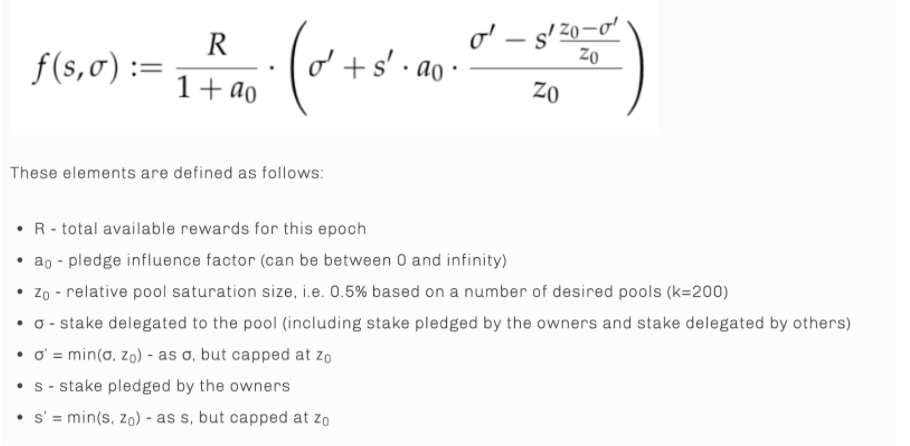

The Cardano protocol has two defining rewards parameters that dictate how the three levers work. They help prevent the Centralization of Cardano by regulating the amount of ADA delegated and the number of pools that an individual controls. These are:

- The K parameter

- The a0 parameter

The K parameter- This is known as the Saturation parameter. Saturation indicates whether a particular stake pool has more stake delegated to it than is ideal for that network. The K is used to indicate the number of desired staking pools. The K parameter and the maximum stake cap per pool have an inverse relationship - the higher the K parameter, the lower the stake cap per pool. Any stake above the maximum limit does not get to earn additional rewards for the stake pool.

Also, as soon as a pool reaches the point of saturation, it offers diminishing rewards.

As of December 2020, the K parameter on Cardano was 500, making the saturation point for a stake pool to be 64 million ADA.

The a0 parameter- This is known as the pledge influence parameter. It defines the influence of the pledge on the pool reward. Since there is no minimum pledge amount, pool operators may pledge some or all of their stake to make their pool more attractive. The higher the pledge, the more reward will be received by the pool, which will then attract more delegation.

.

CARDANO'S REWARDS EQUATION SOURCE

CARDANO REWARD MECHANICS

Some keywords that need to be defined are:

- Pledge amount- This is the number of assets that a user intends to remain staked to a pool for as long as it is in operation.

- Fixed cost- This is a fee first deduced to cover the staking pool operational costs.

- Margin- This is a percentage of the reward taken by the stake pool operator, after the deduction of the fixed cost but before distributing the rewards.

- The reserve- This is the amount of ADA that has not yet been issued out into circulation.

- Expansion rate- This is the amount of ADA used to grant rewards. It is usually approximately 0.3% of the reserve per epoch.

- Staking rate - This is the ratio of ADA actively staked to the total ADA in circulation.

DISTRIBUTING REWARDS

During each Epoch (Epoch refers to a defined group of slots that constitute a period of time), rewards are distributed amongst all stakeholders who have delegated to a public or private staking pool.

The rewards are auto-generated by the protocol itself.

The rewards come from two sources, which are;

Transaction fees- This refers to all the transaction fees collated from transactions processes in a new block.

Monetary Expansion- This involves distinguishing between the total supply of ADA and the maximal supply of ADA. The total supply of ADA consists of all the ADA currently in circulation. The maximum supply of ADA is the maximal amount of ADA in the treasury.

GOALS OF CARDANO STAKING

As mentioned earlier, staking pools can either be private or public.

The private stake pool retains all the profit but must also provide all the staking power. Alternatively, accepting delegation from the public increases the number of entities that receive rewards as delegators get a share of the profit.

By default, a pool with a margin rate of 100% is private and public if it is below 100%.

An operator must decide whether a staking pool will be public or private when setting up. Once that is determined, they can go about optimizing their participation and expected rewards.

POOL PLEDGE MECHANICS

The pool pledge amount is one of the first things a stake pool operator must consider. Pledging refers to the stake pool operator's ability to delegate personal stake to their pool. Pool operators sometimes can pledge some of their stakes to make the pool more attractive. The self‐bonded amount indicates to the network that the stake pool operator has skin in the game. So locking up some of their stakes helps secure the protocol and prevent Sybil Attacks on the Cardano network. The pool reward rate increases as an incentive for operators who pledge ADA, so the higher the pledge amount, the higher the reward rate for the pool.

Once a pool has reached a point of total saturation (the stake cap), it is then eligible for the maximum total amount of rewards.

As the pledge percentage of the total stake decreases, the rewards also decrease and vice-versa.

OPTIMIZED PLEDGING FOR PRIVATE AND PUBLIC POOLS

Private stake pool operators get the maximum rewards by pledging their whole stake cap in the pool. If an Operator has the required amount of ADA to equate the saturation point alone, their rewards will be 100% of the potential earnings when adjusted for the a0 parameter.

In a public stake pool, the pledge amount is balanced with an expected delegated amount. Delegators must consider the pledge amount of a stake pool when choosing a stake pool. A high pledge most times indicates a long-term commitment to operating the stake pool. Thus it increases the delegator rewards, as dictated by the a0 parameter.

A high pledge amount also may result in less room for productive contributions from other delegators' tokens before reaching the stake cap.

Sometimes, Pool operators may decide to adjust their pledge amount over time, while some pool operators may focus on other rewards factors, community engagement, or promoting their stake pool’s robust performance as an alternative method for attracting outside delegation.

POOL FEE MECHANICS

Since the Private stake pool Operators keep 100% of their rewards margin, there is no need to determine the appropriate pool cost or pool margin. So the pool cost is set at the minimum allowed by the protocol and the margin set to 100%.

It is different in the case of Public pool operators because they earn both fixed and variable fees from delegators for conducting the service of validation. After an Epoch ends, the stake operator retains a set amount of ADA (the pool cost). The amount is to cover the operational costs for the pool operator regardless of market fluctuations. They also receive a percentage of the remaining pool rewards (pool margin). This margin is set by the pool operators and provides an opportunity to scale rewards earned with the pool's success.

The public pool operators must decide on the fixed fee and margin rate to optimize the rewards for the delegators and themselves. These fees, however, are subject to changes due to

- Changes in market factors

- Fluctuations in the cost of ADA

- Changes in the pool operation costs

- Increase or Decrease in rate of delegation to the stake pool.

The minimum for setting up a pool cost is 340 ADA per epoch. Operators are encouraged to set a fixed rate (fixed cost) that precisely reflects the expense and time of running the stake pool. Transparency is a necessity. It requires the pool operator to show the potential delegate if their pool cost is in the higher range and note any special pool features such as the provision of multi-regional failover and enterprise-grade infrastructure that increases operational expenses.

Pool operators set a pool margin that allows their pool to be competitive while also considering its performance. Promoting the special features that your stake pool has, such as 99% uptime, enterprise-grade security, professional node maintenance, or high participation rates, are all reasons to set a higher profit margin for your stake pool. These factors all contribute to increased security and higher validation performance with accompanying higher rewards for your delegators.

HOW DO I GET INVOLVED?

You can use this calculator from Cardano to see the potential rewards that you might earn as a pool operator from different stake pool scenarios, including the amount of pledged and delegated tokens, varying margin rates, fixed pool costs, and more.

Learn more about the Cardano network - its economics, and how the protocol functions in our guide.

The best way to maximize rewards is to operate a stake pool successfully—not missing out on any blocks, being updated and in sync with the chain, and avoiding downtime.

If you want to operate a Cardano stake pool without managing the infrastructure yourself, contact us to get started on the Bison Trails platform.

RUNNING A CARDANO STAKING NODE WITH BISON TRAILS

- Easy-to-use-platform- The platform is user-friendly given the complexity of the underlying technology. The platform's automatic node management workflow frees customers from worrying about checking or managing their active participation and keeping customers in control.

- Enterprise-grade infrastructure security- Bison Trails is one of the most trusted names in the blockchain infrastructure industry, having best-in-class security augmented by information, application, and incident management policies.

- Infrastructure and protocol Engineering experts- Bison Trails have participatory infrastructure and protocol experts. They test all software, infrastructure, and protocol upgrades on their infrastructure, thus detecting any issues early before sending the changes to customers' infrastructure.

- Protocol Knowledge- Dedicated protocol specialists keep customers up-to-date about changes in their stake pool ecosystem. They provide advice, guidance, and insight that arms customers with critical information to improve their participation.

- Premium provides- Bison Trails is one of the best premier multi‐cloud, multi‐region infrastructure providers specializing in permissionless participatory networks.

- Custodian agnostic- Since they are a non-custodial infrastructure provider, they can work with customers to participate in Cardano regardless of your custody solution.

DISCLAIMER

By viewing any material or using the information within this publication, you understand that this is general education material. You can not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here. Trading cryptocurrency has potential rewards but also potential risks. You must be aware of the risks and be willing to accept them to invest in the markets. Only trade with funds you can afford to lose. This publication is neither a solicitation nor an offer to buy/sell cryptocurrency or other financial assets. No representation is made that any account will achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Written by Ayomide Abimbola © Crypto University 2021

Share Posts

Copy Link

cryptouniversity.networkblog/best-c...

Crypto University • 26 February 2026

Best Crypto Exchanges for Beginners (2026): Fees, Safety, UX

Discover the top crypto exchanges for beginners in 2026, focusing on low fees, robust security, and intuitive user experience. Find your ideal platform to start trading crypto safely.

Crypto University • 1 January 1970

OKX vs Bybit: Which Is Better for Beginners

Confused between OKX and Bybit? This beginner’s guide compares features, fees, and security to help you choose the best crypto exchange for your needs.

Crypto University • 1 January 1970

How to Evaluate a Crypto Token: Supply, Unlocks, Liquidity, Narrative

Learn how to evaluate crypto tokens by understanding key factors like supply, unlocks, liquidity, and narrative. Make informed investment decisions with Crypto University.